Your Trusted Medicare Advisor

Thank You For Visiting Our Page

get to know The CookS

Everyone needs effective and affordable health insurance at a price they can afford. We work with the nation's top carriers.

We can help you save money on doctor visits, low-cost prescription medication and preventative health services.

We work tirelessly to find you coverage that fits your lifestyle, needs, and budget.

Our Partners

Your Medicare Options

Medicare Resources

Compare & enroll in medicare advantage

Not All Carrier Options May Be Available To Compare And Enroll. To Get Started Click Here

Your Trusted Medicare Advisor

Original Medicare 101

How Does Original Medicare Work?

Original Medicare is one of your health coverage choices as part of Medicare. You’ll have Original Medicare unless you choose a Medicare Advantage Plan or other type of Medicare health plan. You generally have to pay a portion of the cost for each service covered by Original Medicare.

What services does Medicare cover?

- Medicare Part A and Part B cover certain medical services and supplies in hospitals, doctors’ offices, and other health care settings.

- Prescription drug coverage is provided through Medicare Part D.

Part A (Hospital Insurance) helps cover:

- Inpatient care in a hospital

- Inpatient care in a skilled nursing facility (not custodial or long-term care) •

- Hospice care

- Home health care

- Inpatient care in a religious nonmedical health care institution

Medicare Part B (Medical Insurance) helps cover:

- medically necessary doctors’ services

- outpatient care

- home health services

- durable medical equipment

- mental health services, and other medical services.

- Covers many preventive services.

Under Original Medicare, if the Part B deductible ($185 in 2019) applies, you must pay all costs (up to the Medicare-approved amount) until you meet the yearly Part B deductible. After your deductible is met, Medicare begins to pay its share and you typically pay 20% of the Medicare-approved amount of the service, if the doctor or other health care provider accepts assignment. There’s no yearly limit for what you pay out-of-pocket.

How does Medicare prescription drug coverage (Part D) work?

- Medicare prescription drug coverage is an optional benefit.

- Medicare drug coverage is offered to everyone with Medicare.

- Even if you don’t use prescription drugs now, you should consider joining a Medicare drug plan.

- If you decide not to join a Medicare drug plan when you’re first eligible, and you don’t have other creditable prescription drug coverage or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later.

Original Medicare doesn’t cover include:

- Most dental care

- Eye exams related to prescribing glasses

- Dentures

- Cosmetic surgery

- Massage therapy

- Routine physical exams

- Acupuncture

- Hearing aids and exams for fitting them

- Long-term care

- Concierge care (also called concierge medicine, retainer-based medicine, boutique medicine, platinum practice, or direct care)

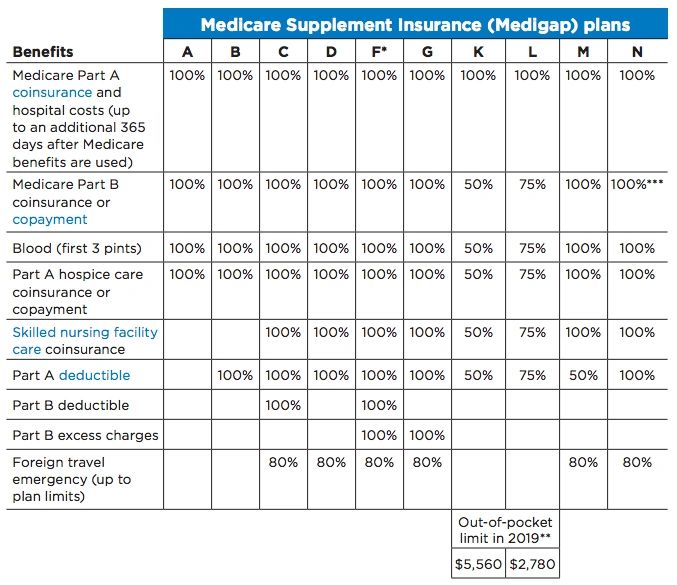

Medicare Supplement 101

What is Medicare Supplement Insurance (a.k.a. Medigap)?

Basic Medicare a.k.a. Original Medicare includes Parts A and B, which is going to pay 80 percent of your basic hospital and doctor expenses. Unfortunately, 20 percent of the expenses Medicare does not cover becomes the responsibility of the beneficiary. A Medicare Supplement is a private plan designed to protect you from paying the 20 percent original Medicare will not cover.

Who is Eligible for Medicare Supplement Insurance?

- You are currently covered under Medicare Parts A & B

- You are within 6 months of turning 65

- You are within 6 months of receiving Part B coverage

- If you are about to lose your group health insurance plan

When Can I Sign Up for Medicare Supplement Insurance?

- The Initial Enrollment Period. During your first 6 months of Part B coverage, your acceptance is guaranteed, regardless of your current level of health

- The "Guaranteed Issue" Period. If you are on the verge of losing coverage through an employer, you will have a "guaranteed issue" period lasting 63 days where you can purchase any Medicare supplement policy with no health questions asked.

If applying for a Medicare supplement outside of these time periods, you will need to qualify for a plan by going through medical underwriting and answering a lot of health questions.

Customers have questions, you have answers. Display the most frequently asked questions, so everybody benefits.

Medicare Advantage 101

What are Medicare Advantage Plans?

A Medicare Advantage Plan is another way to get your Medicare coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare.

If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance) coverage from the Medicare Advantage Plan, not Original Medicare. Most plans include Medicare prescription drug coverage (Part D).

In most cases, you’ll need to use health care providers who participate in the plan’s network. However, many plans offer out-of network coverage, but sometimes at a higher cost.

Remember, you must use the card from your Medicare Advantage Plan to get your Medicare-covered services. Keep your red, white, and blue Medicare card in a safe place because you’ll need it if you ever switch back to Original Medicare.

Who is Eligible for Medicare Advantage Plan?

- You are currently covered under Medicare Parts A & B

- You are within 6 months of turning 65

- You are within 6 months of receiving Part B coverage

- If you are about to lose your group health insurance plan

- You live in the plan’s service area.

- You don’t have End-Stage Renal Disease (ESRD). If you have End-Stage Renal Disease (ESRD), you can only join a Medicare Advantage Plan in certain situations.

When Can I Sign Up for Medicare Advantage Plan?

- When you first become eligible for Medicare, you can sign up during your Initial Enrollment Period.

- If you have Part A coverage and you get Part B for the first time during the General Enrollment Period, you can also join a Medicare Advantage Plan at that time.

- Between October 15–December 7, anyone with Medicare can join, switch, or drop a Medicare Advantage Plan. Your coverage will begin on January 1, as long as the plan gets your request by December 7.

Always review the materials your plan sends you (like the “Annual Notice of Change” and “Evidence of Coverage”), and make sure your plan will still meet your needs for the following year.

Customers have questions, you have answers. Display the most frequently asked questions, so everybody benefits.

Veterans

If You already have va health care benefits, should you sign up for medicare when you turn 65?

The VA encourages Veterans to sign up for Medicare as soon as they can. This is because:

- They don’t know if Congress will provide enough funding in future years for us to provide care for all Veterans who are signed up for VA health care. If you’re in one of the lower priority groups, you could lose your VA health care benefits in the future.

- Having Medicare means you’re covered if you need to go to a non-VA hospital or doctor—so you have more options to choose from.

- If you delay signing up for Medicare Part B (coverage for doctors and outpatient services) and then need to sign up later because you lose your VA health care benefits or need more choice in care options, you’ll pay a penalty. This penalty gets bigger each year you delay signing up—and you’ll pay it every year for the rest of your life.

- If you sign up for Medicare Part D (coverage for prescription drugs), you’ll be able to use it to get medicine from non-VA doctors and fill your prescriptions at your local pharmacy instead of through the VA mail-order service. There’s no penalty for delaying Medicare Part D.

If you have other forms of health care coverage (like a private insurance plan, Medicare, Medicaid, or TRICARE), you can use VA health care benefits along with these plans. To find out what other benefits you may qualify for Click Here.

Learn more about how VA works with other health insurance by Clicking Here.

Contact Us Today

Your Trusted Medicare Advisor

Hours

Open today | 09:00 am – 05:00 pm |

Copyright © 2022 Freedom Financial Consultants LLC - 1509 Lady St Ste N Columbia, SC 29201- All Rights Reserved.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact medicare.gov or 1-800-MEDICARE to get information on all of your options.

Cookie Policy

This website uses cookies. By continuing to use this site, you accept our use of cookies.

Are you a veteran?

Do You Have Medicare Part A and Part B?

Need More Dental and Vision Benefits?